Accounting For Managers - Cost Estimation And Control-Cost Accounting

Summary and Case Analysis-Cost Accounting

Posted On :

Traditional accounting or financial accounting can no longer serve the purposes of all concerned.

Summary

Traditional accounting or financial accounting can no longer serve the purposes of all concerned. Especially the internal organs of the business concerns, namely managements, want a lot of analytical information which could not be provided by the financial accounting. Hence to serve the needs of management two more kinds of accounts – management accounting and cost accounting have evolved. Simply stated, management accounting serves the needs of management and cost accounting tries to determine the costs through a formal system of accounting. Costs can be classified on various bases and cost sheet is a statement presenting the items entering into cost of products or services.

Case Analysis

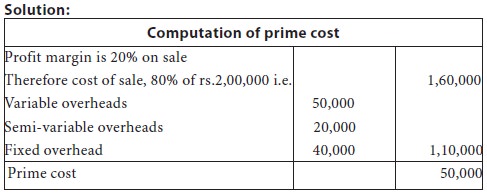

A small scale manufacturer produces an article at the operated capacity of 10,000 units while the normal capacity of his plant is 14,000 units. Working at a profit margin of 20% on sales realisation, he has formulated his budget as under:

10,000 units | 14,000 units | |

Rs. | Rs. | |

Sales

realisation | 2,00,000 | 2,80,000 |

Variable

overheads | 50,000 | 70,000 |

Semi-variable

overheads | 20,000 | 22,000 |

Fixed

overheads | 40,000 | 40,000 |

He gets an order for a quantity equivalent to 20% of the operated Capacity and even on this additional production profit margin is desired At the same percentage on sales realisation as for production to operated Capacity. As you are a cost manager, he approached you to advise him as To what should be the minimum price to realise this objective.

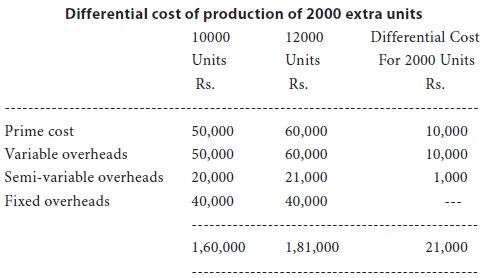

Since an additional production of 4000 units requires an increase of rs.2000 in semi-variable expenses, an additional production of 2000 units will require an increase of rs.1000 in semi-variable expenses:

The different cost for 1 unit is rs.21000 ÷ 2000 units i.e. Rs.10-50. Profit margin required is 20% on sale or 25% on cost. Hence the minimum selling price = rs.10.50 + rs.2.625 = rs.13.125.

Tags : Accounting For Managers - Cost Estimation And Control-Cost Accounting

Last 30 days 1889 views