Accounting For Managers - Cost Estimation And Control-Cost Accounting

Cost Sheet-Cost Accounting

Posted On :

Cost sheet is a statement presenting the items entering into cost of products or services.

Cost

Sheet

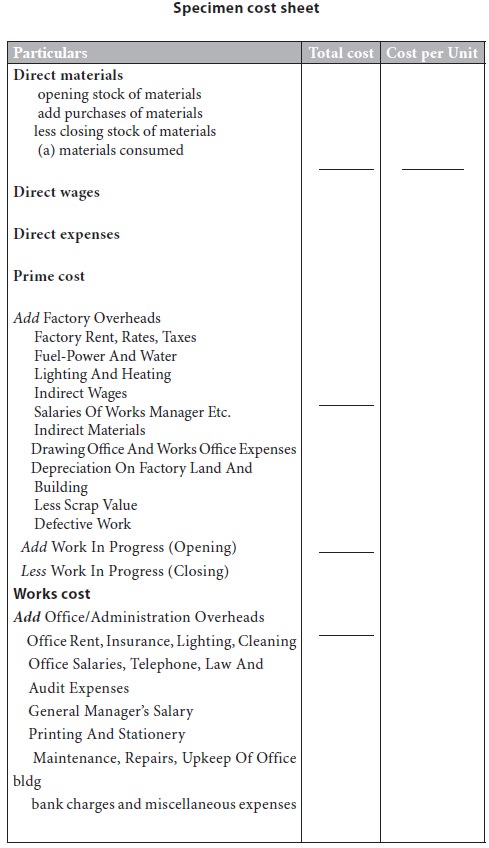

Cost sheet is a statement presenting the items entering into cost of products or services. It shows the total cost components by stages and cost per unit of output during a period. It is usually prepared to meet three objectives: to provide the classification of costs in a summarised form, to prepare estimates of costs for future use and to facilitate a comparative study of costs with previous cost sheets to know the cost trends.

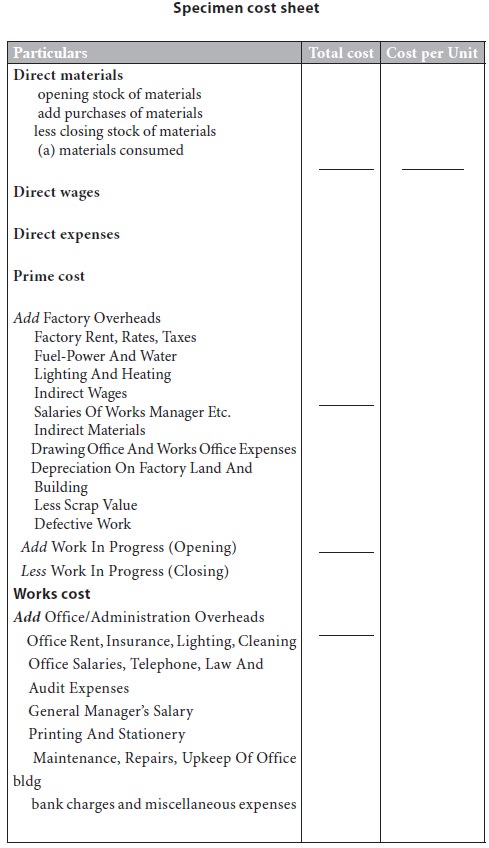

The layout of a typical cost sheet is provided below:

Treatment of certain items in the cost sheet:

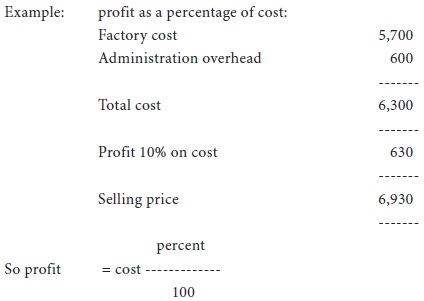

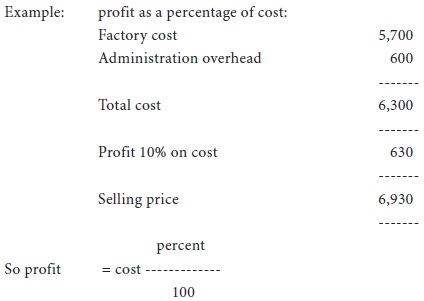

(a) Computation Of Profit: profit may be calculated either as a Percentage of cost or selling price.

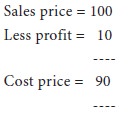

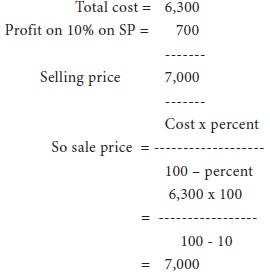

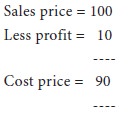

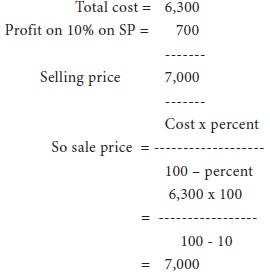

Example: Profit as a percentage of selling price. Here the percentage is on Selling price. Selling price includes Cost + Profit.

This profit of rs.10 is on rs.90 which is the cost price. So it is 1/9th of cost price. In the above example,

(b) Treatment Of Stock: the term `stock’ includes three items: raw materials, work in progress and finished goods. The value of raw materials is arrived at in the following manner:

Opening stock of raw material

Add purchases

Add expenses involved in the purchases of raw material

Cost sheet is a statement presenting the items entering into cost of products or services. It shows the total cost components by stages and cost per unit of output during a period. It is usually prepared to meet three objectives: to provide the classification of costs in a summarised form, to prepare estimates of costs for future use and to facilitate a comparative study of costs with previous cost sheets to know the cost trends.

The layout of a typical cost sheet is provided below:

Treatment of certain items in the cost sheet:

(a) Computation Of Profit: profit may be calculated either as a Percentage of cost or selling price.

Example: Profit as a percentage of selling price. Here the percentage is on Selling price. Selling price includes Cost + Profit.

This profit of rs.10 is on rs.90 which is the cost price. So it is 1/9th of cost price. In the above example,

(b) Treatment Of Stock: the term `stock’ includes three items: raw materials, work in progress and finished goods. The value of raw materials is arrived at in the following manner:

Opening stock of raw material

Add purchases

Add expenses involved in the purchases of raw material

Less closing stock of raw materials

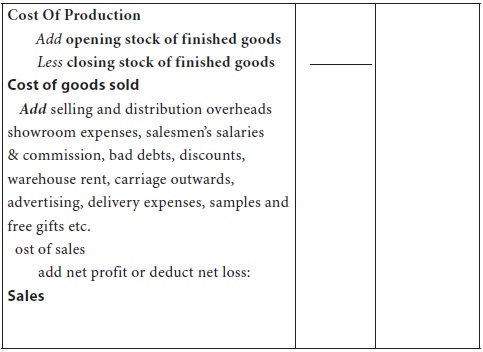

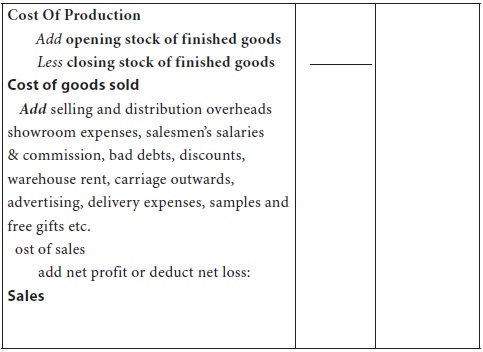

Work-in-progress represents the quantity of semi-finished goods at the time of the preparation of the cost sheet. It represents cost of materials, labour and manufacturing expenses to-date. Work-in-progress may be shown in the cost sheet either immediately after the prime cost or after the calculation of the factory overheads, as shown in the specimen cost sheet. Finally, in respect of stock of finished goods, adjustments have to be made where opening and closing stock of finished goods are given. This is done, as shown in the specimen cost sheet, by adding opening stock of finished goods to the cost of production arrived at on the basis of current figures and reducing the closing stock of finished goods from this total. Let’s explore these aspects more clearly through the following illustrations:

While preparing tenders or quotations, manufacturers or contractors have to look into the figures pertaining to the previous year as shown in the cost sheet for that period. These figures have to be suitably modified in the light of changes expected in the prices of materials, labour, etc., and submit the tender or quotation accordingly.

Work-in-progress represents the quantity of semi-finished goods at the time of the preparation of the cost sheet. It represents cost of materials, labour and manufacturing expenses to-date. Work-in-progress may be shown in the cost sheet either immediately after the prime cost or after the calculation of the factory overheads, as shown in the specimen cost sheet. Finally, in respect of stock of finished goods, adjustments have to be made where opening and closing stock of finished goods are given. This is done, as shown in the specimen cost sheet, by adding opening stock of finished goods to the cost of production arrived at on the basis of current figures and reducing the closing stock of finished goods from this total. Let’s explore these aspects more clearly through the following illustrations:

Tenders And Quotations:

While preparing tenders or quotations, manufacturers or contractors have to look into the figures pertaining to the previous year as shown in the cost sheet for that period. These figures have to be suitably modified in the light of changes expected in the prices of materials, labour, etc., and submit the tender or quotation accordingly.

Tags : Accounting For Managers - Cost Estimation And Control-Cost Accounting

Last 30 days 2651 views