Managerial Economics - Market Structure

Price Discrimination - Market Structure

Posted On :

Price discrimination means that the producer charges different prices for different consumers for the same goods and service.

Price

Discrimination

Price discrimination means that the producer charges different prices for different consumers for the same goods and service. Price discrimination occurs when prices differ even though costs are same. For example, Doctors charge different fees for different customers. In case they charge different prices in different markets, people go to the market where price is low. Then it gets equalized in the long run. There are various types of price discrimination:

They are:

1. Personal Discrimination

2. Place Discrimination

3. Trade Discrimination

4. Time Discrimination

5. Age Discrimination

6. Sex Discrimination

7. Location Discrimination

8. Size Discrimination

9. Quality Discrimination

10. Special Service

11. Use of services

12. Product Discrimination

1. To dispose the surpluses

2. To develop new market

3. To Maximize use of unutilized capacity

4. To Earn monopoly profit

5. To Retain export market

6. To Increase the sales

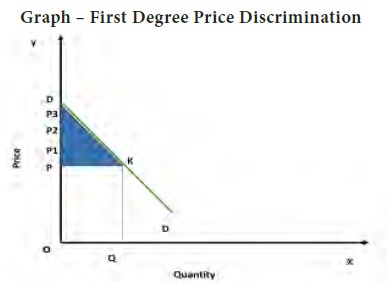

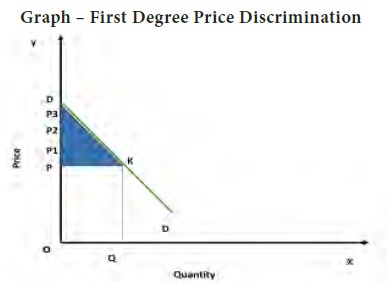

Firm charges a different price to each of its customers. The maximum willingness to pay is fixed as price which is called as reservation price. In perfect market the difference between demand and marginal revenue is the profit (for additional unit producing and selling). Firms do not know the customers willingness, therefore different prices. In imperfect market it is not possible to price for each and every customer.

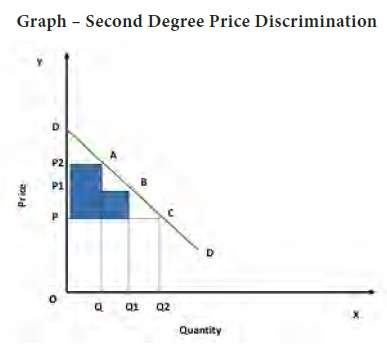

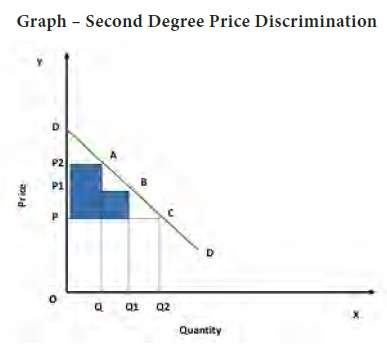

Firm charges different prices per unit for different quantities of the same goods or service. They follow block pricing method. The units in a particular block will be uniformly priced. The possible maximum price is charged for some given minimum block of output purchased by the buyers and then the additional blocks are sold at lower prices.

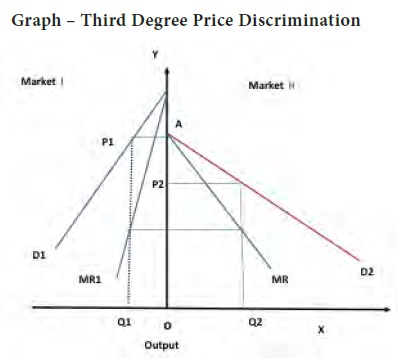

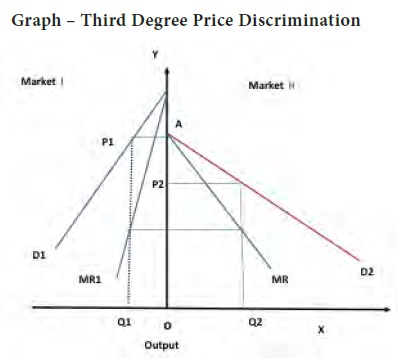

Firm segments the customers into groups with separate demand curves and charges different prices from each group.

In first degree price discrimination, in case of unit wise differing prices, the second degree price discrimination is a case of block wise differing prices. In second degree discrimination a part of consumer’s surplus is captured. But the third degree is commonly used. The firm divides its total output into many submarkets and sets different prices for its product in each market in relation to the demand elasticity.

There are two markets I and II their demand curves D1 and D2 is given. D1 is less elastic and D2 is more elastic demand curve. The firm distributes OQ1 to market - I at OP1 price and OQ2 to the market II at OP2 price. Market- I has less elastic demand therefore higher price is charged.

The pricing mechanisms in different market structures provide a sound theoretical base to understand how price and output decisions are made. There are several other methods commonly followed in practice. However, price discrimination does not receive social and moral justification in the society.

Price discrimination means that the producer charges different prices for different consumers for the same goods and service. Price discrimination occurs when prices differ even though costs are same. For example, Doctors charge different fees for different customers. In case they charge different prices in different markets, people go to the market where price is low. Then it gets equalized in the long run. There are various types of price discrimination:

They are:

1. Personal Discrimination

2. Place Discrimination

3. Trade Discrimination

4. Time Discrimination

5. Age Discrimination

6. Sex Discrimination

7. Location Discrimination

8. Size Discrimination

9. Quality Discrimination

10. Special Service

11. Use of services

12. Product Discrimination

Objectives Of Price Discrimination:

1. To dispose the surpluses

2. To develop new market

3. To Maximize use of unutilized capacity

4. To Earn monopoly profit

5. To Retain export market

6. To Increase the sales

Degrees Of Price Discrimination:

First Degree Price Discrimination:

Firm charges a different price to each of its customers. The maximum willingness to pay is fixed as price which is called as reservation price. In perfect market the difference between demand and marginal revenue is the profit (for additional unit producing and selling). Firms do not know the customers willingness, therefore different prices. In imperfect market it is not possible to price for each and every customer.

Second Degree Discrimination:

Firm charges different prices per unit for different quantities of the same goods or service. They follow block pricing method. The units in a particular block will be uniformly priced. The possible maximum price is charged for some given minimum block of output purchased by the buyers and then the additional blocks are sold at lower prices.

Third Degree Discrimination:

Firm segments the customers into groups with separate demand curves and charges different prices from each group.

In first degree price discrimination, in case of unit wise differing prices, the second degree price discrimination is a case of block wise differing prices. In second degree discrimination a part of consumer’s surplus is captured. But the third degree is commonly used. The firm divides its total output into many submarkets and sets different prices for its product in each market in relation to the demand elasticity.

There are two markets I and II their demand curves D1 and D2 is given. D1 is less elastic and D2 is more elastic demand curve. The firm distributes OQ1 to market - I at OP1 price and OQ2 to the market II at OP2 price. Market- I has less elastic demand therefore higher price is charged.

The pricing mechanisms in different market structures provide a sound theoretical base to understand how price and output decisions are made. There are several other methods commonly followed in practice. However, price discrimination does not receive social and moral justification in the society.

Tags : Managerial Economics - Market Structure

Last 30 days 1107 views