Business Environment and Law-Minimum Wages Act, 1948

Objects And Scope Of The Act - Minimum Wages Act, 1948

Posted On :

It must be understood that wages that are paid to a workman is not paid exclusively to him, but it is paid to his family as a unit.

Objects

And Scope Of The Act:

The Minimum Wages Act contemplates,

1. The wages that are paid to the workers should meet their physical needs and at the same time,

2. Keep them above starvation level.

3. It should ensure sustenance for their family; and

It must be understood that wages that are paid to a workman is not paid exclusively to him, but it is paid to his family as a unit. Therefore, such a wage should enable a worker to sustain his family by meeting certain necessary expenses which are inevitable; such as

a. Medical expenses

b. Expenses to meet education for his children; and

c. In some cases, transport charges.

Minimum wages that are fixed for workmen have some significance:

a. Minimum wages are not fixed on Equation principle, namely, money payable towards wages must be commensurate with the labour output.

b. Equally, minimum wages are not based on the economic principle, namely those who are able financially, must be capable of paying more to the workers.

c. On the other hand, it is based on ethical principle of pre-judging and assessing the needs of a workman and his family as a unit and making provision for his wages. To put it in a nutshell, minimum wages are considered to be need-based wages, which is according to the directive principle of our Constitution.

The framework of minimum wags hinges on cost of living index, now known as Consumer Index. Cost of living forms an integral part in the fixation of wages for workers. But then, the cost of essential commodities increases now and then because of which a workman finds it hard to lead his life. The essential requirements for providing a staple food consisting of protein, carbohydrates, fat, vitamin, etc., are computed and calculated in terms of price from the available essential commodities.

Calculation of Cost of Living Index: Upto 100 points they merge with the salary. Over and above 100 points, when there is an increase in the cost of these essential commodities, the workers find it difficult to procure these commodities to eke out their livelihood. This renders the position of a workers equivalent to a stage termed as ‘between the cup and the lip.”

Fixation of wage is no doubt a subtle task, which requires a device for balancing the demand of social justice and the need for improving the sources of national income from the pint of raising he standard of living.

Payment of wages is mandatory.

Irrespective of the fact whether an industry is big or small. Whether it makes

profit or not, minimum wages must be paid to the workmen concerned. A human

being must always be allowed to lead a decent life; hence, it is not permitted

to pay wages, which is hardly sufficient to make the workman to keep his body

and soul together.

Minimal requirements of the worker concerned should be provided under minimum wages. A living wage has been defined as the wage received for normal needs of an average employee regarded as a human being living in a civilized community. A living wage enables a worker to enjoy comfort in life.

The wages mentioned above are not

static as they keep on changing, according to the economic scenario of the

nation. To neutralize or standardize the two extreme wage limits, namely,

minimum wage and living wage, the concept of fair wage is introduced as a via

media, as given below:

A fair wage is said to be a mean between minimum wage and living wage. Every attempt was made to introduce a fair wage, but then it could not be fixed at the upper limit. Hence, sometimes, fair wage also descends to the level of minimum wage.

Minimum wage is said to be the starting stage from the point of view of offering social security to workmen. Labourer’s demand should always be viewed with sympathy and hence minimum wages must be paid compulsorily. If an employer is unable to pay even minimum wages or it becomes impossible on his part to carry on his business, then it would be better for him to close his business.

For the purpose of understanding the Minimum Wages Act, it essential to know the following definitions contained in the Act

“Appropriate Government’ [Section 2(b)] means –

1. In relation to any scheduled employment carried on by or under the authority of the central Government or a Railway Administration or in relation to a mine, oil-field or major port, or any corporation established by the Central Government, and

2. In relation to any other

scheduled employment under the State Government.

4. “Cost of living index number” in

relation to employees in any scheduled

employment in respect of which minimum rates of wages have been fixed, means

the index number ascertained and declared by the competent authority by

notification in the official Gazette to be the cost of living index number

applicable to employees in such employment;

5. “Employer” means any person who employs,

whether directly or through another

person, or whether on behalf of himself or any other person, one or more employees

in any scheduled employment in respect of which minimum rates of wages have

been fixed under this Act, and includes, Except in sub-section (3) of Section

26;

6. “Prescribed” means prescribed by rules made under this Act;

The Minimum Wages Act contemplates,

1. The wages that are paid to the workers should meet their physical needs and at the same time,

4. Also enable them to subsist by

preserving their efficiency as workmen in day-to-day life.

Components In The Minimum Wage:

It must be understood that wages that are paid to a workman is not paid exclusively to him, but it is paid to his family as a unit. Therefore, such a wage should enable a worker to sustain his family by meeting certain necessary expenses which are inevitable; such as

a. Medical expenses

b. Expenses to meet education for his children; and

c. In some cases, transport charges.

Concept Of Minimum Wage

Minimum wages that are fixed for workmen have some significance:

a. Minimum wages are not fixed on Equation principle, namely, money payable towards wages must be commensurate with the labour output.

b. Equally, minimum wages are not based on the economic principle, namely those who are able financially, must be capable of paying more to the workers.

c. On the other hand, it is based on ethical principle of pre-judging and assessing the needs of a workman and his family as a unit and making provision for his wages. To put it in a nutshell, minimum wages are considered to be need-based wages, which is according to the directive principle of our Constitution.

Cost Of Living Index [Section 2 (D)]:

The framework of minimum wags hinges on cost of living index, now known as Consumer Index. Cost of living forms an integral part in the fixation of wages for workers. But then, the cost of essential commodities increases now and then because of which a workman finds it hard to lead his life. The essential requirements for providing a staple food consisting of protein, carbohydrates, fat, vitamin, etc., are computed and calculated in terms of price from the available essential commodities.

Calculation of Cost of Living Index: Upto 100 points they merge with the salary. Over and above 100 points, when there is an increase in the cost of these essential commodities, the workers find it difficult to procure these commodities to eke out their livelihood. This renders the position of a workers equivalent to a stage termed as ‘between the cup and the lip.”

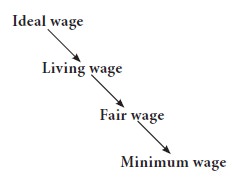

Minimum Wages, Fair Wages And Living Wages

Fixation of wage is no doubt a subtle task, which requires a device for balancing the demand of social justice and the need for improving the sources of national income from the pint of raising he standard of living.

Minimal requirements of the worker concerned should be provided under minimum wages. A living wage has been defined as the wage received for normal needs of an average employee regarded as a human being living in a civilized community. A living wage enables a worker to enjoy comfort in life.

A fair wage is said to be a mean between minimum wage and living wage. Every attempt was made to introduce a fair wage, but then it could not be fixed at the upper limit. Hence, sometimes, fair wage also descends to the level of minimum wage.

Minimum wage is said to be the starting stage from the point of view of offering social security to workmen. Labourer’s demand should always be viewed with sympathy and hence minimum wages must be paid compulsorily. If an employer is unable to pay even minimum wages or it becomes impossible on his part to carry on his business, then it would be better for him to close his business.

For the purpose of understanding the Minimum Wages Act, it essential to know the following definitions contained in the Act

“Appropriate Government’ [Section 2(b)] means –

1. In relation to any scheduled employment carried on by or under the authority of the central Government or a Railway Administration or in relation to a mine, oil-field or major port, or any corporation established by the Central Government, and

3. Competent authority means the

authority appointed by the appropriate Government by notification in its

official Gazette to ascertain from time to time the cost of living index number

applicable to the employees employed in the scheduled employment specified in

such notification;

6. “Prescribed” means prescribed by rules made under this Act;

7. “Scheduled employment” means an

employment specified in the Schedule,

or any process or branch of work forming part of such employment;

8. “Wages” means all remunerations, capable

of being expressed in terms of

money, which would, if the terms of the contract of employment, express or implied,

were fulfilled, be payable to a person employed in respect of his employment or

of work done in such employment and includes house rent allowance.

9. “Employee” means any person who is employed

for hire or reward to do any work

skilled or unskilled, manual or clerical, in a scheduled employment in respect

of which minimum rates of wages have been fixed; and includes an out-worker to

whom any articles or materials are given out by another person to be made up,

cleaned, washed, altered ornamented, finished, repaired, adapted or otherwise

processed for sale for the purposes of the trade or business of that other

person where the process is to be carried out either in the home of the

outworker or in some other premises not being premises under the control and

management of that other person; and also includes an employee declared to be

an employee by the appropriate Government; but does not include any member of

the Armed Forces of Union.

Tags : Business Environment and Law-Minimum Wages Act, 1948

Last 30 days 3685 views