Accounting For Managers - Preparation of Final Accounts

Explanation Of Items On The Income Stataement, Sales Revenue & Miscellaneous Or Secondary Sources Of Revenues:

The heading of the income statement must show:

I)

the business enterprise to which

it relates (ali akbar ltd.) Ii) the name of the statement (income statement)

Iii) the

time period covered (year ended 31st march of the relevant

The

income statement is generally followed by various schedules that give detailed

account of the items, listed on them. Information about these schedules are

given against each item in the financial statements.

One important objective in reporting revenue on an income statement is

to disclose the major source of revenue and to separate it from miscellaneous

sources. For most companies the major source of revenue is the sale of goods

and services.

Sales Revenue:

An income statement often reports several separate items in the sales

revenue section, the net of which is the net sales figure. Gross sales is the

total invoice price of the goods sold or services rendered during the period.

It should not include sales taxes or excise duties that may be charged to the

customers. Such taxes are not revenues but rather represent collections that the

business makes on behalf of the government and are liabilities to the

government until paid. Similarly, postage, freight or other items billed to the

customers at cost are not revenues. These items do not appear in the sales

figure but instead are an offset to the costs the company incurs for them.

Sales returns and allowances represent the sales values of goods that were

returned by customers or allowance made to customers because the goods were

defective. The amount can be subtracted from the sales figure directly without

showing it as a separate item on the income statement. But it is always better

to show them separately.

Sometimes called as cash discounts, sales discounts are the amount of

discounts allowed to customers for prompt payment. For e.g. If a business

offers a 3% discount to customers who pay within 7 days from the date of the

invoice and it sells rs.30,000 of goods to a customer who takes advantage of

this discount, the business receives only rs.29,100 in cash and records the

balance rs.900 as sales discount. There is another kind of discount called as

trade discount which is given by the wholesaler or manufacturer to the

retailers to enable them to sell at catalogue price and make a profit: e.g.

List less 30 percent. Trade discount does not appear in the accounting records

at all.

Miscellaneous

Or Secondary Sources Of Revenues:

These are revenues earned from activities not associated with the sale

of the enterprise’s goods and services. Interest or dividends earned on

marketable securities, royalties, rents and gains on disposal of assets are

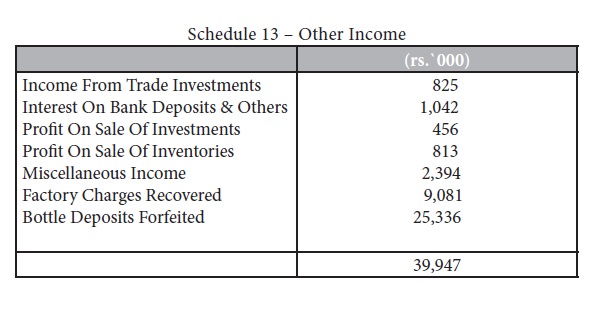

examples of this type of revenues. For e.g. In the case of ali akbar ltd., its

operating loss has been converted into net profit only because of other income,

other than sales revenue. Schedule 13 gives details of other income earned by

ali akbar ltd.

Schedule

13 – Other Income

when income is increased by the sale value of goods or services sold, it

is also decreased by the cost of these goods or services. The cost of goods or

services sold is called the cost of sales. In manufacturing firms and retailing

business it is often called the cost of goods sold. The complexity of

calculation of cost of goods sold varies depending upon the nature of the

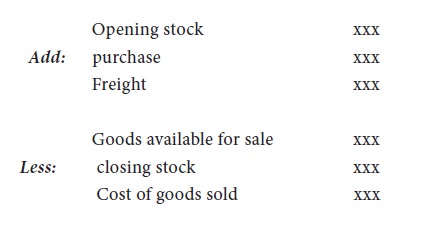

business. In the case of a trading concern which deals in commodities it is

very simple to calculate the most of goods sold and it is done as follows:

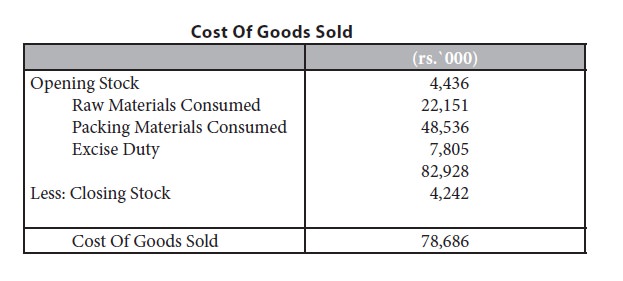

The calculation becomes a complicated process in the case of manufacturing concern, especially when a number of products are manufactured because it involves the calculation of the work in progress and valuation of inventory. The cost of goods sold in the case of ali akbar ltd., would have been calculated as given in illustration `e’.

Illustration E:

Cost Of Goods Sold

Gross Profit:

The excess of sales revenue over cost of goods sold is gross margin or gross profit. In the case of multiple-step income statement it is shown as a separate item. Significant managerial decisions can be taken by calculating the percentage of gross profit on sale. This percentage indicates the average mark up obtained on products sold. The percentage varies widely among industries, but healthy companies in the same industry tend to have similar gross profit percentages.

Operating Expenses:

Expenses which are incurred for running the business and which are not directly related to the company’s production or trading are collectively called as operating expenses. Usually operating expenses include administration expenses, finance expenses, depreciation and selling and distribution expenses. Administration expenses generally include personnel expenses also. However sometimes personnel expenses may be shown separately under the heading establishment expenses.

Until recently most companies included expenses on research and development as part of general and administrative expenses. But now-a-days the financial accounting standards board (fasb) requires that this amount should be shown separately. This is so because the expenditure on research and development could provide an important clue as to how cautious the company is in keeping its products and services up to date.

Operating Profit: operating profit is obtained when operating expenses are deducted from gross profit.

Non-Operating Expenses:

These are expenses which are not related to the activities of the business e.g. Loss on sale of asset, discount on shares written off etc. These expenses are deducted from the income obtained after adding other incomes to the operating profit. Other incomes or miscellaneous receipts have already been explained. The resultant profit is called as profit (or) earning before interest and tax (ebit).

Interest Expenses:

Interest expense arises when part of the expenses are met from borrowed funds. The fasb requires separate disclosure of interest expense. This item of expense is deducted from income or earnings before interest and tax. The resultant figure is profit (or) earnings before tax (ebt).

Income Tax: the provision for tax is estimated based on the quantum of profit before tax. As per the corporate tax laws, the amount of tax payable is determined not on the basis of reported net profit but the net profit arrived at has to be recomputed and adjusted for determining the tax liability. That is why the liability is always shown as a provision.

Net Profit:

This is the amount of profit finally available to the enterprise for

Appropriation. Net profits is reported not only in total but also per share of stock. This per share amount is obtained by dividing the total amount of net profit by the number of shares outstanding. The net profit is usually referred to as profit or earnings after tax. This profit could either be distributed as dividends to shareholders or retained in the business. Just like gross profit percentage, net profit percentage on sales can also be calculated which will be of great use for managerial analysis.