Managerial Economics - Market Structure

Kinked Demand Curve - Market Structure

Posted On :

When a firm increases its price, the rival firms do not follow it by increasing their prices in turn this increases its market share.

Kinked

Demand Curve

When a firm increases its price, the rival firms do not follow it by increasing their prices in turn this increases its market share. When a firm reduces its price rival firms immediately follows it by decreasing their prices. If they do not do so, customers go to the firm which is offering at lower price. This is the fundamental behaviour of the firms in an oligopoly market. Let us understand the unique characteristic feature of kinked demand curve.

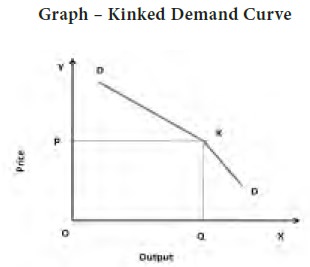

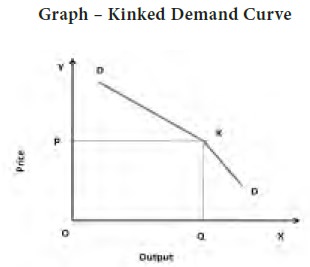

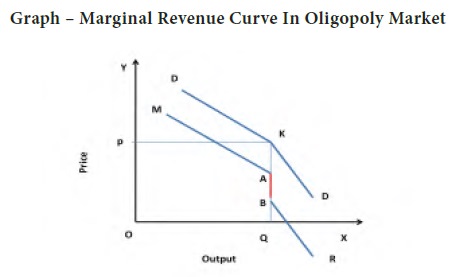

The demand curve in oligopoly has two parts. (i) relatively elastic demand curve (ii) relatively inelastic demand curve as shown in the graph below. In oligopoly market firms are reluctant to change prices even if the cost of production (or) demand changes. Price rigidity is the basis for the kinked demand curve. Each firm faces demand curve kinked at the currently prevailing price. At higher prices demand is highly elastic, whereas at lower prices it is inelastic.

From the graph we can understand that OP is the given price. There is a kink at point K on demand curve (DD). Therefore DK is the elasticity segment and KD is the inelastic segment. There is a change in the slope of the demand curve at K. At this situation the firm follows the prevailing price and does not make any change in it because rising of price would contract sales as demand tends to be more elastic at this stage. I would also fear losing buyers due to competitor’s price who have not raised their prices. On the other hand lowering of price would imply an immediate retaliation from the rivals on account of close interdependence of price, output movement in the oligopoly market. Therefore the firm will not expect much rise in sale with price reduction.

The average revenue curve and the demand curve (DD) of an oligopoly firm has a kink. The kinked average revenue curve implies a discontinuation in the marginal revenues curve. It explains the phenomenon of price rigidity in oligopoly market.

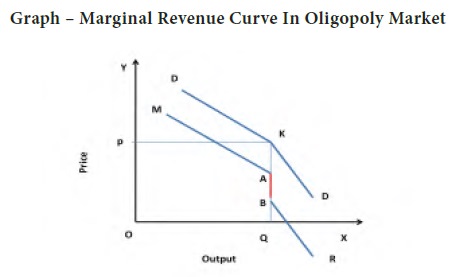

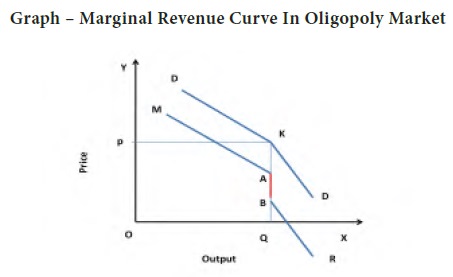

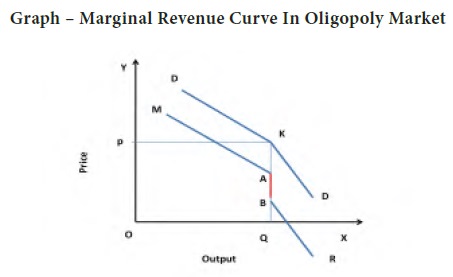

The price output level that

maximizes the profits for a firm is derived from the equilibrium point, which

lies at the intersection of the MC and the MR curves. The price output

combination can remain optimal at the kink even though the MC fluctuates

because of the associated gap in the MR curve. This is shown in the graph. The

profit maximizing price OP and output combination of OQ remains unchanged as

long as MC fluctuates between MC1 and MC2 that is between A and B. Hence there

is price rigidity- it means OP does not change. It is concluded that once a general

price level is reached it remains unchanged over a period of time in oligopoly

market.

When a firm increases its price, the rival firms do not follow it by increasing their prices in turn this increases its market share. When a firm reduces its price rival firms immediately follows it by decreasing their prices. If they do not do so, customers go to the firm which is offering at lower price. This is the fundamental behaviour of the firms in an oligopoly market. Let us understand the unique characteristic feature of kinked demand curve.

The demand curve in oligopoly has two parts. (i) relatively elastic demand curve (ii) relatively inelastic demand curve as shown in the graph below. In oligopoly market firms are reluctant to change prices even if the cost of production (or) demand changes. Price rigidity is the basis for the kinked demand curve. Each firm faces demand curve kinked at the currently prevailing price. At higher prices demand is highly elastic, whereas at lower prices it is inelastic.

From the graph we can understand that OP is the given price. There is a kink at point K on demand curve (DD). Therefore DK is the elasticity segment and KD is the inelastic segment. There is a change in the slope of the demand curve at K. At this situation the firm follows the prevailing price and does not make any change in it because rising of price would contract sales as demand tends to be more elastic at this stage. I would also fear losing buyers due to competitor’s price who have not raised their prices. On the other hand lowering of price would imply an immediate retaliation from the rivals on account of close interdependence of price, output movement in the oligopoly market. Therefore the firm will not expect much rise in sale with price reduction.

The average revenue curve and the demand curve (DD) of an oligopoly firm has a kink. The kinked average revenue curve implies a discontinuation in the marginal revenues curve. It explains the phenomenon of price rigidity in oligopoly market.

Tags : Managerial Economics - Market Structure

Last 30 days 1500 views