Strategic Management - Strategy Implementation

Strategic Evaluation and Control - Strategy Implementation

Posted On :

The process of evaluation basically deals with four steps:

Strategic Evaluation and

Control

The process of evaluation basically deals with four steps:

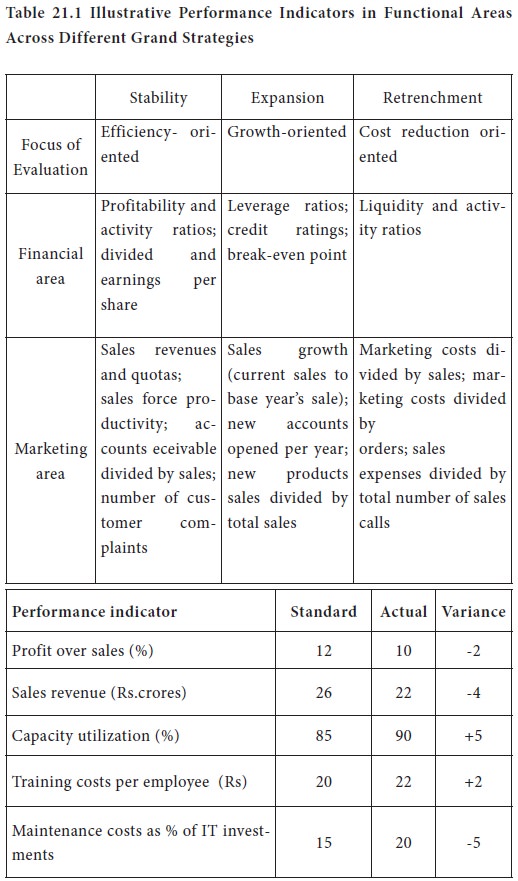

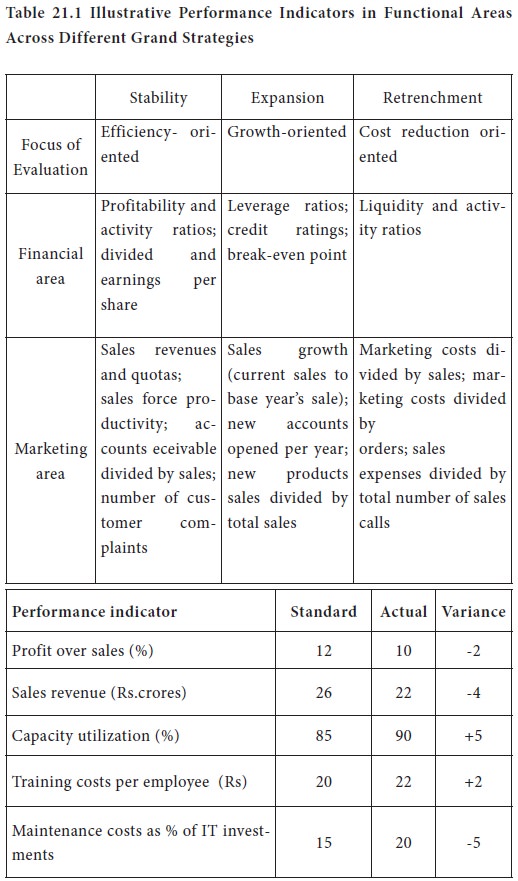

1. Setting standards of performance-Standards refer to performance expectations. Table 21-1 illustrates standards

2. Measurement of performance-Measurement of actual performance or results requires appraisal based on standards.

3. Analyzing variances- The comparison between standards and results gives variances. Table 21-2 shows how variances can be found.

4. Taking

corrective action-The identifications of undesirable variances prompt managers

to think about ways of corrective them.

Strategic evaluation is important due to several factors.

Within an organization, there is a need to receive feedback on current performance, so that good performance is rewarded and poor performance is corrected.

Strategic evaluation helps to keep a check on the validity of a strategic choice. An ongoing process of evaluation would, in fact, provide feedback on the continued relevance of the strategic choice made during the formulation phase.

During the course of strategy implementation managers are required to take scores of decisions. Strategic evaluation can help to assess whether the decisions match the intended strategy requirements.

Lastly, the process of strategic evaluation provides a considerable amount of information and experience to strategists that can be useful in new strategic planning.

The various participants in strategic evaluation and control and their respective roles are

Shareholders, lenders and the public They have ownership claim on the assets of the enterprise and are therefore responsible to the strategic performance and evaluation.

Board of Directors enacts the formal role of reviewing and screening executive decisions in the light of the environment and business organizational implications.

Chief executives are ultimately responsible for all the administrative aspects of strategic evaluation and control.

SBU or profit-centre heads may be involved in performance evaluation at their levels and may facilitate evaluation by corporate-level executives.

Financial controllers, company secretaries, and external and internal auditors form the group of persons who are primarily responsible for operational control based on financial analysis, budgeting, and reporting. Audit and executive committees, set up by the Board or the chief executive, may be charged with the responsibility of continuous screening of performance.

Corporate planning staff or department may also be involved in strategic evaluation.

Middle-level managers may participate in strategic evaluation and control as providers of information and feedback, and as the recipients of directions from above, to take corrective actions.

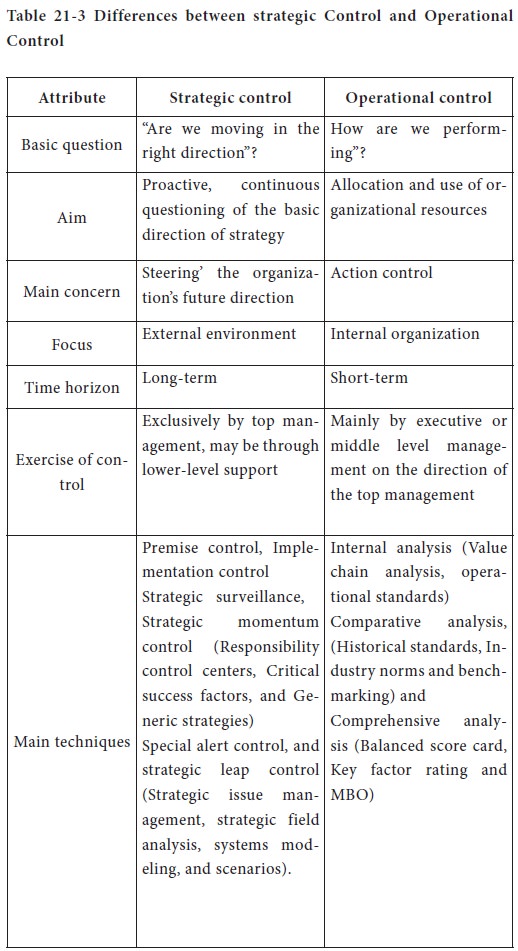

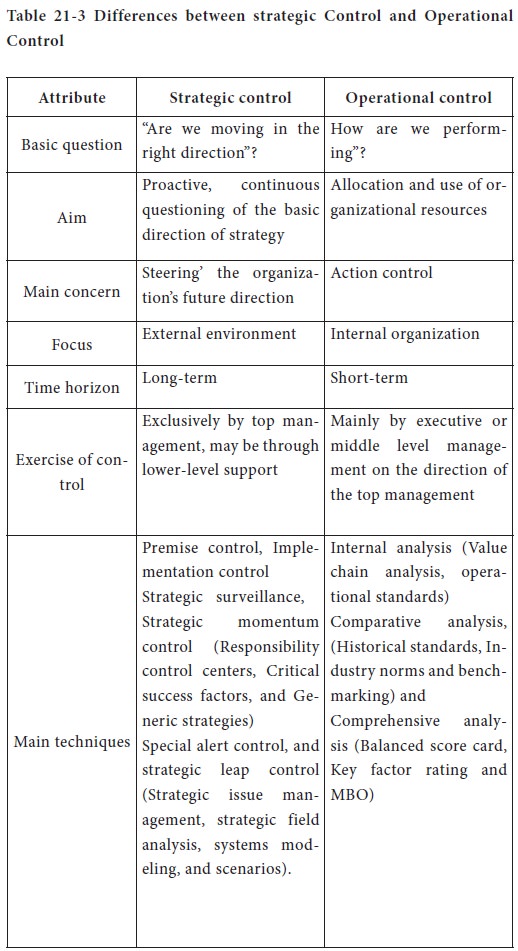

Controls can be broadly classified into two categories. : Strategic and operational control. Strategic control is aimed at monitoring the course of progress in the predetermined direction, and operational control with the allocation of organizational resources and evaluation of the performance of organizational units, such as, divisions, SBUs, and so on, to assess their contribution to the achievement of organizational objectives. Table 21-3 shows the differences.

Source

2. Key factor rating is a

method that takes into account the key factors in several areas and then sets out to evaluate performance on the

basis of these. This is quite a comprehensive method as it takes a holistic

view of the performance areas in an organization.

3. Management by Objectives (MBO) is a system, proposed by Drucker, which is based on a regular evaluation of performance against objectives, which are decided upon, mutually by the superior and the subordinate. By the process of consultation, objective setting leads to the establishment of a control system that operates on the basis of commitment and self-control.

4. Memorandum of understanding (MoU) is “an agreement between a public enterprise and the Government, represented by the administrative ministry in which both parties clearly specify their commitments and responsibilities”. Having done that, the enterprises are evaluated on the basis of the MoU.

The process of evaluation basically deals with four steps:

1. Setting standards of performance-Standards refer to performance expectations. Table 21-1 illustrates standards

2. Measurement of performance-Measurement of actual performance or results requires appraisal based on standards.

3. Analyzing variances- The comparison between standards and results gives variances. Table 21-2 shows how variances can be found.

Importance

Strategic evaluation is important due to several factors.

Need for feedback

Within an organization, there is a need to receive feedback on current performance, so that good performance is rewarded and poor performance is corrected.

Validates strategic choice

Strategic evaluation helps to keep a check on the validity of a strategic choice. An ongoing process of evaluation would, in fact, provide feedback on the continued relevance of the strategic choice made during the formulation phase.

Congruence between decisions and intended strategy

During the course of strategy implementation managers are required to take scores of decisions. Strategic evaluation can help to assess whether the decisions match the intended strategy requirements.

New Strategy planning

Lastly, the process of strategic evaluation provides a considerable amount of information and experience to strategists that can be useful in new strategic planning.

Participants in Strategic Evaluation

The various participants in strategic evaluation and control and their respective roles are

Shareholders, lenders and the public They have ownership claim on the assets of the enterprise and are therefore responsible to the strategic performance and evaluation.

Board of Directors enacts the formal role of reviewing and screening executive decisions in the light of the environment and business organizational implications.

Chief executives are ultimately responsible for all the administrative aspects of strategic evaluation and control.

SBU or profit-centre heads may be involved in performance evaluation at their levels and may facilitate evaluation by corporate-level executives.

Financial controllers, company secretaries, and external and internal auditors form the group of persons who are primarily responsible for operational control based on financial analysis, budgeting, and reporting. Audit and executive committees, set up by the Board or the chief executive, may be charged with the responsibility of continuous screening of performance.

Corporate planning staff or department may also be involved in strategic evaluation.

Middle-level managers may participate in strategic evaluation and control as providers of information and feedback, and as the recipients of directions from above, to take corrective actions.

Types of strategic controls

Controls can be broadly classified into two categories. : Strategic and operational control. Strategic control is aimed at monitoring the course of progress in the predetermined direction, and operational control with the allocation of organizational resources and evaluation of the performance of organizational units, such as, divisions, SBUs, and so on, to assess their contribution to the achievement of organizational objectives. Table 21-3 shows the differences.

Source

Based on J A Pearce-III and R B Robinson, Jr.

Strategic Management: Strategy Formulation and Implementation, 3rd edn, Richard

D Irwin, Homewood, Ill, 1988,pp 404-19.

The different types of strategic controls are discussed in brief here.

A company may base its strategy on important assumptions related to environmental factors (e.g., government policies), industrial factors (e.g. nature of competition), and organizational factors (e.g. breakthrough in R&D). Premise control continually verifies whether such assumptions are right or wrong. If they are not valid corrective action is initiated and strategy is made right. The responsibility for premise control can be assigned to the corporate planning staff who can identify for assumptions and keep a regular check on their validity.

Implementation control can be done using milestone review. This is similar to the identification-albeit on a smaller scale-of events and activities in PERT/CPM networks. After the identification of milestones, a comprehensive review of implementation is made to reassess its continued relevance to the achievement of objectives.

This is aimed at a more generalized and overarching control. Strategic surveillance can be done through a broad-based, general monitoring on the basis of selected information sources to uncover events that are likely to affect the strategy of an organization.

This is based on a trigger mechanism for rapid response and

These types of evaluation techniques are aimed at finding out what needs to be done in order to allow the organization to maintain its existing strategic momentum. There are three techniques , which could be used to achieve these aims:

• Responsibility control centers,

• Critical success factors, and

• Generic strategies.

Responsibility controls form the core of management control systems and are of four types: revenue, expense, profit, and investment centers.

CSFs form the bases for strategists to continually evaluate the strategies to assess whether or not these are helping the organization to achieve the objectives.

The generic strategies approach to strategic control is based on the assumption that the strategies adopted by a firm similar to another firm are comparable. Based on such a comparison, a firm can study why and how other firms are implementing strategies and assess whether or not its own strategy is following a similar path. In this context, the concept of strategic group is also relevant, A strategic group is a group of firms that adopts similar strategies with similar resources. Firms within a strategic group, often within the same industry and sometimes in other industries too, tend to adopt similar strategies.

Where the environment is relatively unstable, organizations are required to make strategic leaps in order to make significant changes. Strategic leap control can assist such organizations by helping to define the new strategic requirements and to cope with emerging environmental realities. There are four techniques of evaluation used to exercise strategic leap control:

strategic issue management, strategic field analysis, systems modeling, and scenarios.

1. Strategic issue management is aimed at identifying one or more strategic issues and assessing their impact on the organization. A strategic issue is “a forthcoming development, either inside or outside of the organization, which is likely to have an important impact. On the basis of strategic issues, the strategists can avoid surprises and shocks, and design contingency plans to shift strategies whenever required.

2. Strategic field analysis is a way of examining the nature and extent of synergies that exist or are lacking between the components of an organization. Whenever synergies exist the strategists can assess the ability of the firm to take advantage of those. Alternatively, the strategists can evaluate the firm’s ability to generate synergies where they do not exist.

3. Systems modeling is based on computer-based models that simulate the essential features of the organization and its environment. Through systems modeling, organizations may exercise pre-action control by assessing the impact of the environment on organization because of the adoption of a particular strategy.

4. Scenarios are perceptions about the likely environment a firm would face in the future. They enable organizations to focus strategies on the basis of forth-coming developments in the environment.

Several of the above techniques for strategic control-with the possible exception of responsibility centers-are of a relatively recent origin. The development of these techniques is an evidence of the expanding body of

In the next part of this section, we look at techniques for operational control.

Operational control is aimed at the allocation and use of organizational resources. Evaluation techniques for operational control, therefore, are based on organizational appraisal rater than environmental monitoring, as is the case with strategic control. Evaluation techniques can be classified into three parts.

1. Internal analysis,

2. Comparative analysis, and

3. Comprehensive analysis.

Internal analysis deals with the identification of the strengths and weakness of a firm in absolute terms.

Value chain analysis focuses on a set of inter-related activities performed in a sequence for producing and marketing a product or service. The utility of value-chain analysis for the purpose of operational evaluation lies in its ability to segregate the total tasks of a firm into identifiable activities, which can then be evaluated for effectiveness.

An operational standard takes up the financial parameters and the non-financial quantitative parameters, such as, physical units or time, in order to assess Performance. The obvious benefit of using quantitative factors (either financial or physical parameters) is the ease of evaluation and the verifiability of the assessment done. These are probably the most-used methods for evaluation for operational control. Among the scores of financial techniques are traditional techniques, such as, ratio analysis, or newer techniques, such as, economic value-aided (EVA) and its variations, and activity-based costing (ABC). These are proven methods so far as their efficacy for evaluating operational effectiveness is concerned. Apart from the financial quantitative techniques, there are several non-financial control, such as; computation of absenteeism,

Qualitative analysis supplements the quantitative analysis by including those aspects which it is not feasible to measure on the basis of figures and numbers. The methods that could be used for qualitative analysis are based on intuition, judgement, and informed opinion. Techniques like surveys and experimentation can be used for the evaluation of performance for exercising operational control.

It compares the performance of a firm with its own past standards, or standards of other firms.

1. Historical analysis compares the present performance of a firm with performance over a given period of time. This method help analyse the trend or pattern.

2. Industry norms Performance of a company I is compared with the performance of its peers in the same industry. Evaluation on the basis of industry norms enables a firm to bring its performance at least up to the level of other firms and then attempt to surpass it.

3. Bench marking is a comparative method where a firm finds the best practices in an area and then attempts to bring its own performance in that area in line with the best practice. In order to excel, a firm shall have to exceed the benchmarks. In this manner, benchmarking offers firms a tangible method to evaluate performance.

This analysis adopts a total approach rather than focusing on one area of activity, or a function or department.

1. Balanced scorecard method is based on the identification of four key performance measures of customer perspective, internal business perspective, innovation and learning perspective, and the financial perspective. This method is a balanced approach to performance measurement as a range of parameters are taken into account for evaluation.

Strategic controls

The different types of strategic controls are discussed in brief here.

Premise control

A company may base its strategy on important assumptions related to environmental factors (e.g., government policies), industrial factors (e.g. nature of competition), and organizational factors (e.g. breakthrough in R&D). Premise control continually verifies whether such assumptions are right or wrong. If they are not valid corrective action is initiated and strategy is made right. The responsibility for premise control can be assigned to the corporate planning staff who can identify for assumptions and keep a regular check on their validity.

Implementation control

Implementation control can be done using milestone review. This is similar to the identification-albeit on a smaller scale-of events and activities in PERT/CPM networks. After the identification of milestones, a comprehensive review of implementation is made to reassess its continued relevance to the achievement of objectives.

Strategic Surveillance

This is aimed at a more generalized and overarching control. Strategic surveillance can be done through a broad-based, general monitoring on the basis of selected information sources to uncover events that are likely to affect the strategy of an organization.

Special Alert Control

This is based on a trigger mechanism for rapid response and

Strategic momentum control

These types of evaluation techniques are aimed at finding out what needs to be done in order to allow the organization to maintain its existing strategic momentum. There are three techniques , which could be used to achieve these aims:

• Responsibility control centers,

• Critical success factors, and

• Generic strategies.

Responsibility controls form the core of management control systems and are of four types: revenue, expense, profit, and investment centers.

CSFs form the bases for strategists to continually evaluate the strategies to assess whether or not these are helping the organization to achieve the objectives.

The generic strategies approach to strategic control is based on the assumption that the strategies adopted by a firm similar to another firm are comparable. Based on such a comparison, a firm can study why and how other firms are implementing strategies and assess whether or not its own strategy is following a similar path. In this context, the concept of strategic group is also relevant, A strategic group is a group of firms that adopts similar strategies with similar resources. Firms within a strategic group, often within the same industry and sometimes in other industries too, tend to adopt similar strategies.

Strategic leap control

Where the environment is relatively unstable, organizations are required to make strategic leaps in order to make significant changes. Strategic leap control can assist such organizations by helping to define the new strategic requirements and to cope with emerging environmental realities. There are four techniques of evaluation used to exercise strategic leap control:

strategic issue management, strategic field analysis, systems modeling, and scenarios.

1. Strategic issue management is aimed at identifying one or more strategic issues and assessing their impact on the organization. A strategic issue is “a forthcoming development, either inside or outside of the organization, which is likely to have an important impact. On the basis of strategic issues, the strategists can avoid surprises and shocks, and design contingency plans to shift strategies whenever required.

2. Strategic field analysis is a way of examining the nature and extent of synergies that exist or are lacking between the components of an organization. Whenever synergies exist the strategists can assess the ability of the firm to take advantage of those. Alternatively, the strategists can evaluate the firm’s ability to generate synergies where they do not exist.

3. Systems modeling is based on computer-based models that simulate the essential features of the organization and its environment. Through systems modeling, organizations may exercise pre-action control by assessing the impact of the environment on organization because of the adoption of a particular strategy.

4. Scenarios are perceptions about the likely environment a firm would face in the future. They enable organizations to focus strategies on the basis of forth-coming developments in the environment.

Several of the above techniques for strategic control-with the possible exception of responsibility centers-are of a relatively recent origin. The development of these techniques is an evidence of the expanding body of

In the next part of this section, we look at techniques for operational control.

Operational control

Operational control is aimed at the allocation and use of organizational resources. Evaluation techniques for operational control, therefore, are based on organizational appraisal rater than environmental monitoring, as is the case with strategic control. Evaluation techniques can be classified into three parts.

1. Internal analysis,

2. Comparative analysis, and

3. Comprehensive analysis.

Internal analysis

Internal analysis deals with the identification of the strengths and weakness of a firm in absolute terms.

Value chain analysis focuses on a set of inter-related activities performed in a sequence for producing and marketing a product or service. The utility of value-chain analysis for the purpose of operational evaluation lies in its ability to segregate the total tasks of a firm into identifiable activities, which can then be evaluated for effectiveness.

An operational standard takes up the financial parameters and the non-financial quantitative parameters, such as, physical units or time, in order to assess Performance. The obvious benefit of using quantitative factors (either financial or physical parameters) is the ease of evaluation and the verifiability of the assessment done. These are probably the most-used methods for evaluation for operational control. Among the scores of financial techniques are traditional techniques, such as, ratio analysis, or newer techniques, such as, economic value-aided (EVA) and its variations, and activity-based costing (ABC). These are proven methods so far as their efficacy for evaluating operational effectiveness is concerned. Apart from the financial quantitative techniques, there are several non-financial control, such as; computation of absenteeism,

Qualitative analysis supplements the quantitative analysis by including those aspects which it is not feasible to measure on the basis of figures and numbers. The methods that could be used for qualitative analysis are based on intuition, judgement, and informed opinion. Techniques like surveys and experimentation can be used for the evaluation of performance for exercising operational control.

Comparative analysis

It compares the performance of a firm with its own past standards, or standards of other firms.

1. Historical analysis compares the present performance of a firm with performance over a given period of time. This method help analyse the trend or pattern.

2. Industry norms Performance of a company I is compared with the performance of its peers in the same industry. Evaluation on the basis of industry norms enables a firm to bring its performance at least up to the level of other firms and then attempt to surpass it.

3. Bench marking is a comparative method where a firm finds the best practices in an area and then attempts to bring its own performance in that area in line with the best practice. In order to excel, a firm shall have to exceed the benchmarks. In this manner, benchmarking offers firms a tangible method to evaluate performance.

Comprehensive analysis

This analysis adopts a total approach rather than focusing on one area of activity, or a function or department.

1. Balanced scorecard method is based on the identification of four key performance measures of customer perspective, internal business perspective, innovation and learning perspective, and the financial perspective. This method is a balanced approach to performance measurement as a range of parameters are taken into account for evaluation.

3. Management by Objectives (MBO) is a system, proposed by Drucker, which is based on a regular evaluation of performance against objectives, which are decided upon, mutually by the superior and the subordinate. By the process of consultation, objective setting leads to the establishment of a control system that operates on the basis of commitment and self-control.

4. Memorandum of understanding (MoU) is “an agreement between a public enterprise and the Government, represented by the administrative ministry in which both parties clearly specify their commitments and responsibilities”. Having done that, the enterprises are evaluated on the basis of the MoU.

Tags : Strategic Management - Strategy Implementation

Last 30 days 2951 views